EC702 (Graduate-level Macroeconomics)

First-year Ph.D. level Macro at Boston University

I have been teaching assistant to professor Pascual Restrepo and professor Stephen Terry during Fall 2019, Fall 2018, and Fall 2017.

All teaching material, including Matlab and Dynare codes as well as slides, can be found on my course-related Github page. I detail an outline of my lectures as follows 👇.

Discussion 1

Basic theory of differential and difference equations.

Discussion 2

Simplest analytical examples of the Solow growth model in both continuous and discrete time.

Discussion 3

Matlab codes to solve the deterministic Solow growth model in both continuous and discrete time.

Discussion 4

Matlab codes to solve the deterministic “reaching the center” problem. The problem is written using value functions, and then the solution is implemented through value function iteration.

Discussion 5

Matlab codes to solve the deterministic Ramsey growth model and the “cake eating” problem (which is a specific case of the Ramsey model). Both problems are solved using value function iteration.

Discussion 6

Matlab codes to solve the deterministic Ramsey growth model with endogenous labor. This is done using VFI and two alternative methods are presented to solve the model. Two more codes solve for the transition from a steady-state to a new one after a change in the parameters, in particular labor share and TFP.

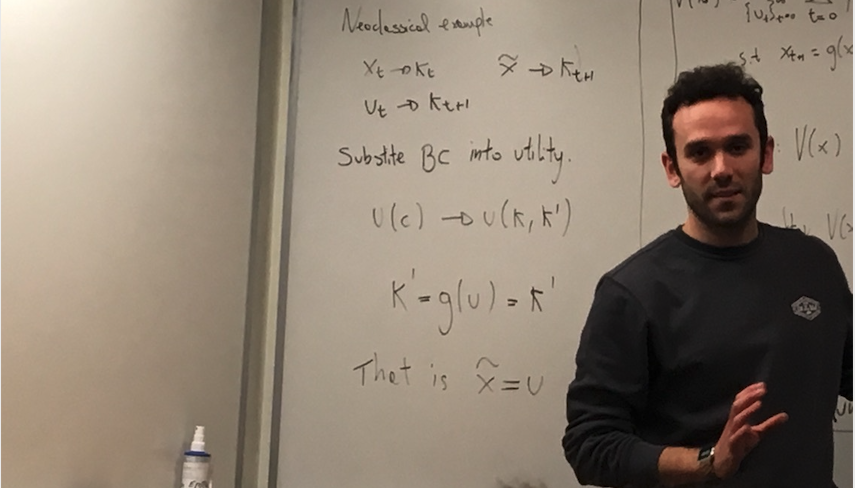

Discussion 7

Matlab codes to solve the continuous time deterministic Neoclassical growth model with and without endogenous labor. We use a procedure called “Relaxation method”, following Trimborn, Koch and Steger (2008).

Discussion 8

Theory of Markov Chains from LS. Theory of Dynamic Programming without uncertainty.

Discussion 9

Theory of Dynamic Programming with uncertainty: iid case and persistent case.

Discussion 10

Some theory on the HP filter and how it compares with other filters. Codes to HP filter the US gdp series. Codes to solve an RBC model in Dynare. Compute and plot moments from simulated moments.

Discussion 11

Matlab codes to solve an RBC model using VFI. We also compute the ergodic distribution and get RCB moments.

Discussion 12

Matlab codes to solve the Aiyagari model both in PE and in GE. The households problem is solved with the endogenous grid method and non-stochastic simulation method. We also simulate the model and compute moments.

Discussion 13

Matlab codes to solve a firm model a la Hopenhayn both in PE and GE. The codes use VFI to get policy functions and a non-stochastic simulation method to get the stationary distribution. We finally simulate the model and compute simulated volatilities and correlation matrices.